The rising tide of tariffs has introduced significant complexity into global markets, leading many manufacturers to grapple with how to balance price increases against customer expectations. These changes highlight the critical role of pricing strategies in maintaining competitiveness and protecting profit margins. A valuable tool in navigating these challenges is the concept of value mapping, a framework that helps businesses assess how customers perceive the trade-off between price and product value.

The Value Mapping Framework

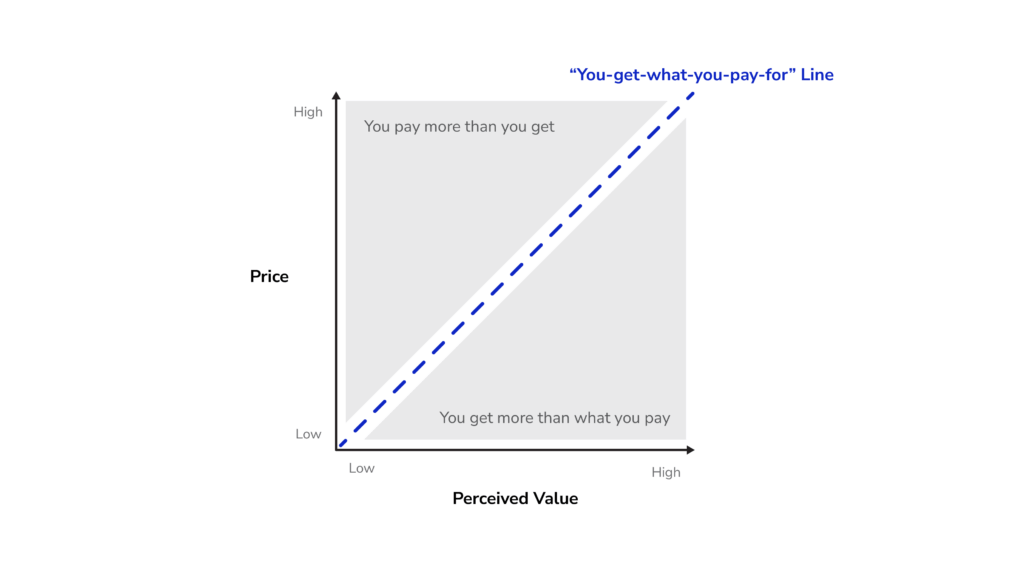

At the heart of the value mapping framework is the “you-get-what-you-pay-for” line, a diagonal on the value-price map where products deliver proportional value to their cost. Products positioned near this line are perceived as offering good value for money. However, deviations from this line — either through overpricing or underpricing — can result in customer dissatisfaction or unsustainable profits. Overpriced products fail to attract customers, while underpriced products may erode margins despite high demand.

Market forces typically drive products toward this diagonal as manufacturers adjust either price, value, or both. However, aligning with this line is not a one-size-fits-all solution. Companies must also account for customer distribution along the line. Some segments, such as price-sensitive or premium buyers, may carry more weight in shaping market strategies.

The Impact of Tariffs

Tariffs disrupt established market dynamics by raising costs for manufacturers, who must then decide whether to absorb these increases or pass them on to customers. These choices push products off the “you get what you pay for” line, jeopardizing competitiveness against less-affected rivals. In cases where tariffs impact most or all products in a category, the value-price diagonal may shift upward, creating a new pricing baseline.

In response, manufacturers can adopt various strategies. Some may increase prices to offset higher costs, while others might invest in added value to justify the price hike. Alternatively, companies with lower exposure to tariffs may use their relative advantage to gain market share or adjust their own pricing to maximize margins.

Data-Driven Pricing Simulations

Understanding how customers will react to price changes is vital, and data-driven simulations offer a way to predict these outcomes. Using surveys with purchasing decision makers, these simulations analyze customer preferences and calculate their willingness to pay for products. The data is then used to locate products on the value map and simulate hypothetical pricing scenarios.

For example, a pricing simulator can predict how price increases, such as those caused by tariffs, affect market share, revenue, and gross margins. By running multiple scenarios, companies can identify optimal pricing strategies that balance market competitiveness and profitability.

Conclusion

In an environment of rising costs and shifting competitive dynamics, understanding pricing power has never been more essential. GLG’s data-driven simulations empower businesses with actionable insights, helping them navigate the complex interplay of price, value, and market behavior. With these tools, companies can make informed decisions to maintain their edge in an ever-evolving marketplace.

Register to view the recording of the complimentary GLG webcast Tackle It In 20: Protect Your Margin.