【無料ウェビナー】米国関税がもたらすアジア諸国の貿易環境の変化 2025

様々な場面での意思決定に、確かな「知見」という選択肢を。

様々な場面での意思決定に、

確かな「知見」という選択肢を。

We bring the power of insight

to every great professional decision.

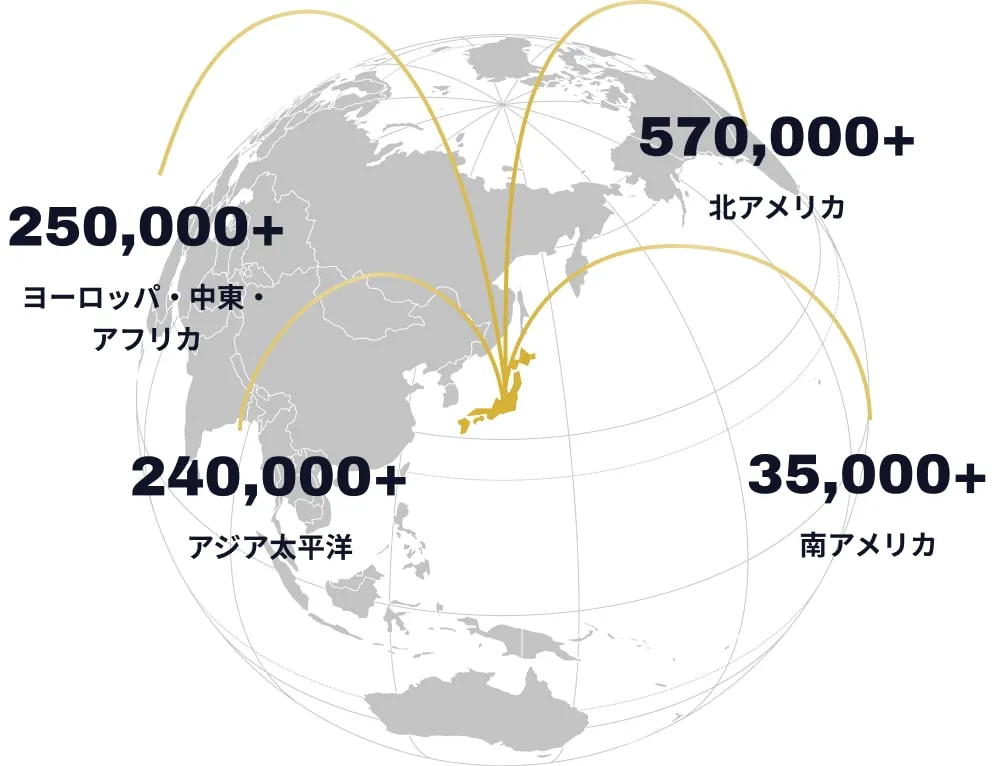

GLGは、世界230の国と地域から集まる約120万人の有識者ネットワークを活用し、企業の意思決定を支援する「スポットコンサルティングサービス」を展開しています。ニッチな領域から最先端の技術トレンドまで、幅広いトピックに対応しています。

エキスパートインタビューをはじめ、業界のキーパーソンを対象とした定量調査(BtoB調査)、各国の市場・競合環境を深く理解するための海外市場調査、現地で実働可能な専門家のアサインに至るまで、目的に応じた最適なアプローチで実用的な知見をお届けします。

根拠に基づく確かな裏付けが、あなたの意思決定を成功に導きます。

Services

GLGの

スポットコンサルサービス一覧

GLGのスポットコンサル

サービス一覧

1時間のインタビューから、中長期の有識者の活用、国境を越えた大規模な調査プロジェクトまで、課題に応じて選べる様々なサービスをご提供しています。

Exclusive Content

GLGが提供する

“もうひとつの知”

オンデマンドでアクセス可能な幅広い知見をご提供しています。最新の業界動向、成長機会と課題、規制の変化、今後の展望など、世界各国の専門家の視点を、必要な時にいつでもご利用いただけます。(※利用にはご契約が必要です)

Use Cases

サービスを選ぶ

課題や目的に関わらず、どのような場面でも、貴社の意思決定をご支援いたします。

Why GLG

GLGが

選ばれる理由

GLGは、世界に広がるネットワーク、信頼性の高い一次情報、徹底したサポート体制により、根拠のある “意思決定” を実現するためのパートナーとして、多くの企業に選ばれています。

[専門性、スピード、安全性]

すべてに妥協しない

スポットコンサルをご提供

01

世界最大級のグローバル

エキスパートネットワーク

幅広い業界・分野の多彩な知見が集まる、約120万の有識者ネットワークの中から、貴社の課題解決や目的達成に適切な有識者を迅速に選定し、ご提案いたします。

02

海外市場への

圧倒的な強み

世界のほぼ全域をカバーする、230の国と地域から有識者が登録しています。さらに、多くの実績を誇る海外調査専門チームが、現地での調査を的確にご支援いたします。

03

安心・安全の

コンプライアンス体制

厳格なコンプライアンス・フレームワークのもと、サービスをご利用いただく企業様と有識者の利益相反の可能性を見極めて適切に管理。両者の利益を確実にお守りいたします。

04

経験豊富で、

信頼性の高いアドバイザー

企業の元経営幹部や業界の熟練者など、その道のプロフェッショナルにご登録いただいています。経験に基づく信頼性の高い知見をご提供いたします。

05

24時間、

日本語でサポート

日本オフィスの営業時間外には、海外在住の日本人スタッフが対応。夜間や早朝に発生した緊急案件にも、日本語で速やかに対応いたします。

GLGアドバイザーのご紹介

GLGには “実務の中枢” を知る有識者が多数登録しています。

元 UPS 社長

Jeff McCorstin

元 UPS 社長

Jeff McCorstin

UPSに33年間在籍。世界各地の通関および貿易コンプライアンス対応、アジア太平洋地域、欧州、中東、アフリカにおける航空、海上、鉄道、陸上貨物輸送の管理など、幅広い業務に携わった経験を持つ。サプライチェーン・ロジスティクスの専門家

日東電工株式会社 エレクトロニクス部門講師、元日東電工株式会社 営業リーダー

横山 秀則

日東電工株式会社 エレクトロニクス部門講師、元日東電工株式会社 営業リーダー

横山 秀則

アクリル系粘着シート、光学高透明テープなどの製品営業の経験と知識を持つ専門家。日東電工に約44年勤務、スマートフォンのタッチパネル用高透明光学粘着テープやPDPなどの営業における豊富な経験を持つ

元 Apple チーフ・オブ・スタッフ

Jeanne Williams

元 Apple チーフ・オブ・スタッフ

Jeanne Williams

エンジニアリングと人事分野における20年にわたる成功事例の開発と推進経験を有する。シニアプログラムマネージャー兼オペレーションリーダーとして活躍し、Googleでのプロジェクトマネジメント経験も持つ

東食、日本コカ・コーラ、日本ケンタッキー・フライド・チキン、 西友、食品コンサルタント

坂部 明

東食、日本コカ・コーラ、日本ケンタッキー・フライド・チキン、 西友、食品コンサルタント

坂部 明

食品商社、メーカー、流通、小売り、外食と 食品・飲料分野における45年の実務経験を持ち 販売・流通・商品開発・品質保証・危機管理・ 人権労務等カバーしている食品分野の専門家

Case Studies

GLGスポットコンサルの活用事例

GLGのスポットコンサルは、様々な分野の幅広いシーンで活用されています。

eBooks

お役立ち資料

市場調査の結果や調査方法のヒントなど、実践に活かせる有識者のインサイトをご活用ください。

GLGアドバイザーとして

活動しませんか?

これまでのキャリアで培った業界の知見を活かして、企業の課題解決をご支援いただけませんか?ご都合のよい時間に、1時間から活動いただけます。登録無料。

GLG中途採用

企業の意思決定を、ともにご支援いただけるメンバーを募集しています。グローバルな環境で専門性を磨き、挑戦する機会をご提供しています。カジュアル面談も受付中。

FAQ

よくあるご質問

Q どのような企業がスポットコンサルサービスを利用していますか?

国内の大手事業会社(例:製造業、自動車、医療機器、製薬、化学・素材メーカー、消費財 など) 、金融サービス業(プライベートエクイティファンド、ミューチュアルファンド、投資銀行、証券会社 など)、大手コンサルティングファームなど、業界を問わず幅広くご利用いただいています。

Q どのような有識者が登録していますか?

世界で230カ国から、あらゆる業種や分野のエキスパートにご登録いただいています。特に、業界経験の長い熟練者や事業会社の元経営幹部などのシニア層が多いのが、GLGの特徴です。各業界分野における具体的な登録者については、個別にお問い合わせをお願いいたします。

Q スポットコンサルサービスの費用を教えていただけますか?

ご利用いただくサービスや調査スコープによって異なります。貴社の課題や目的、ご興味のあるサービスなどをお伺いした上でお見積りをご提出させていただきますので、まずはお気軽にお問い合わせください。

Q アドバイザー活動に興味があります。誰でも登録できますか?

特定の専門分野において十分な知見をお持ちの方(当該業界で5年以上の経験を目安)は、どなたでもご登録いただけます。また、企業に在職中、離職中、退職済み、フリーランスの方など、キャリアステージを問わすご登録いただけます。詳細は、ご登録ページをご覧ください。

User Voice

一つひとつの意思決定が、ビジネスを成功に導いていく。

GLGはその後押しをしています。

米国市場の最適なディストリビューターに出会えました

米国市場への新規参入を計画していましたが、現地での販売網構築にあたり、信頼できるディストリビューターの情報や接点を得ることが課題でした。GLGを利用することで、米国市場に精通した専門家を通じて具体的なディストリビューター名とそれぞれの企業特性を的確に把握でき、効率的なアプローチと関係構築が実現しました。

業界を知り尽くした有識者の支援力の高さに驚きました

新たに自律走行が可能な産業用小型輸送機器を開発したものの、その応用分野が幅広く、優先順位付けに苦慮していました。GLGのネットワークを活用し、米国先進ロボティクス企業の創業者をプロジェクトチームに迎え入れることで、網羅的かつ客観的な調査と分析を実施できました。明確な根拠に基づく優先付けが可能となり、製品展開の初期段階で確実な成功を収めることができました。

サービス資料ダウンロード

GLGのサービス内容や活用事例を

まとめた資料をご用意しています。

具体的な導入検討や社内共有にぜひご活用ください。

お問い合わせ

「どのサービスがあっているのか相談したい」「費用感を教えて欲しい」など、お気軽にご相談ください。GLGの経験豊富なスタッフが、最適なサービスをご提案いたします。